Do Homeowners Really Understand Their Insurance or Are They Just Paying the Bill?

Do Homeowners Really Understand Their Insurance or Are They Just Paying the Bill?

Most homeowners feel confident about their insurance, but many don't fully understand it. Learn why coverage clarity is more crucial than ever.Home insurance is supposed to be a safety net, but what if that net has holes homeowners don’t even know about? With premiums rising and disasters becoming more frequent, understanding what’s covered and what’s not has never been more important. We surveyed over 1,000 American homeowners to uncover whether they truly grasp their coverage or if they’re simply paying the bill and hoping for the best.

Key Takeaways

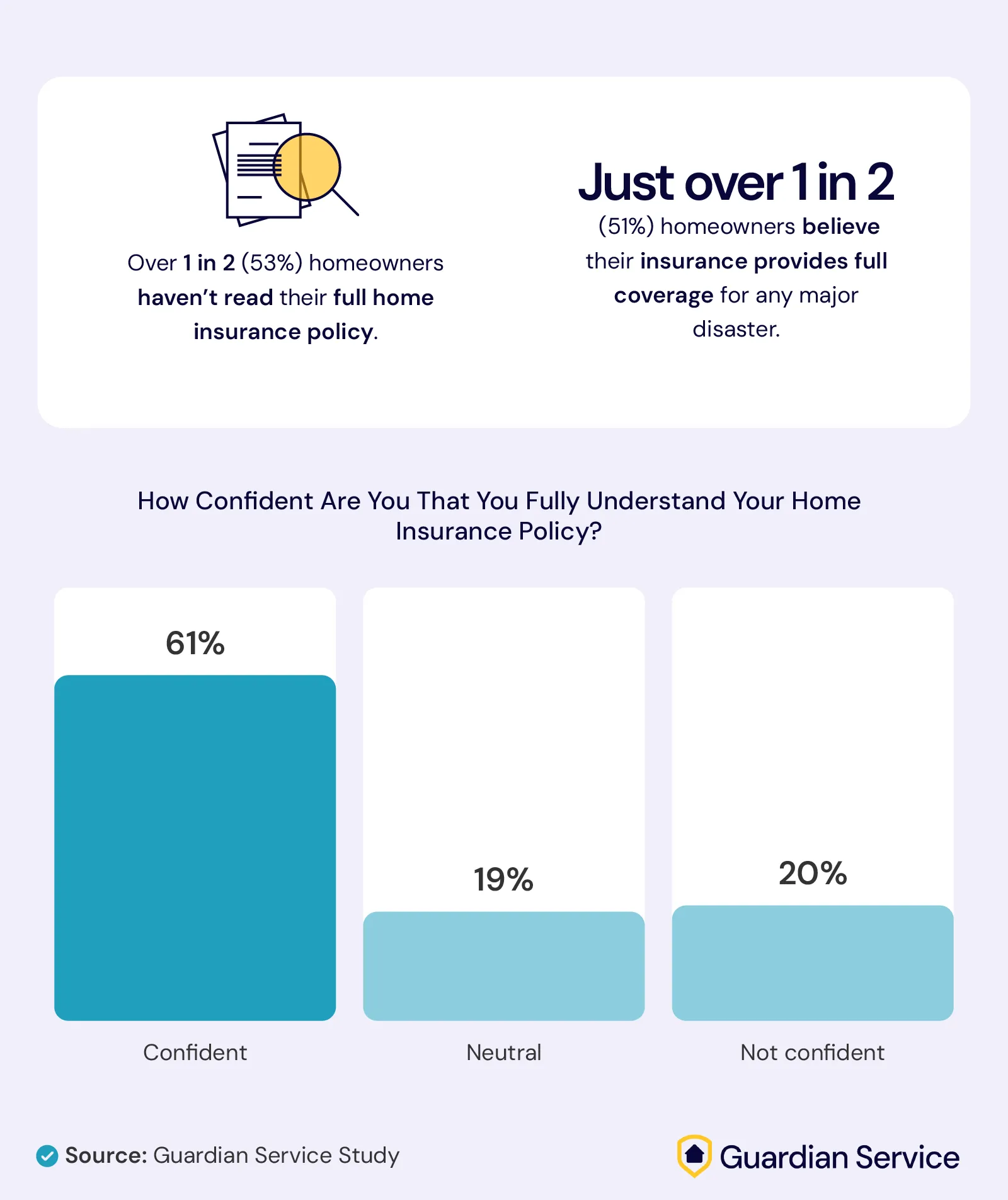

- Over 1 in 2 (53%) homeowners haven’t read their full home insurance policy.

- 1 in 5 (20%) homeowners don’t fully understand their home insurance policy. Gen Z is the least confident, with only 55% saying they fully understand their coverage.

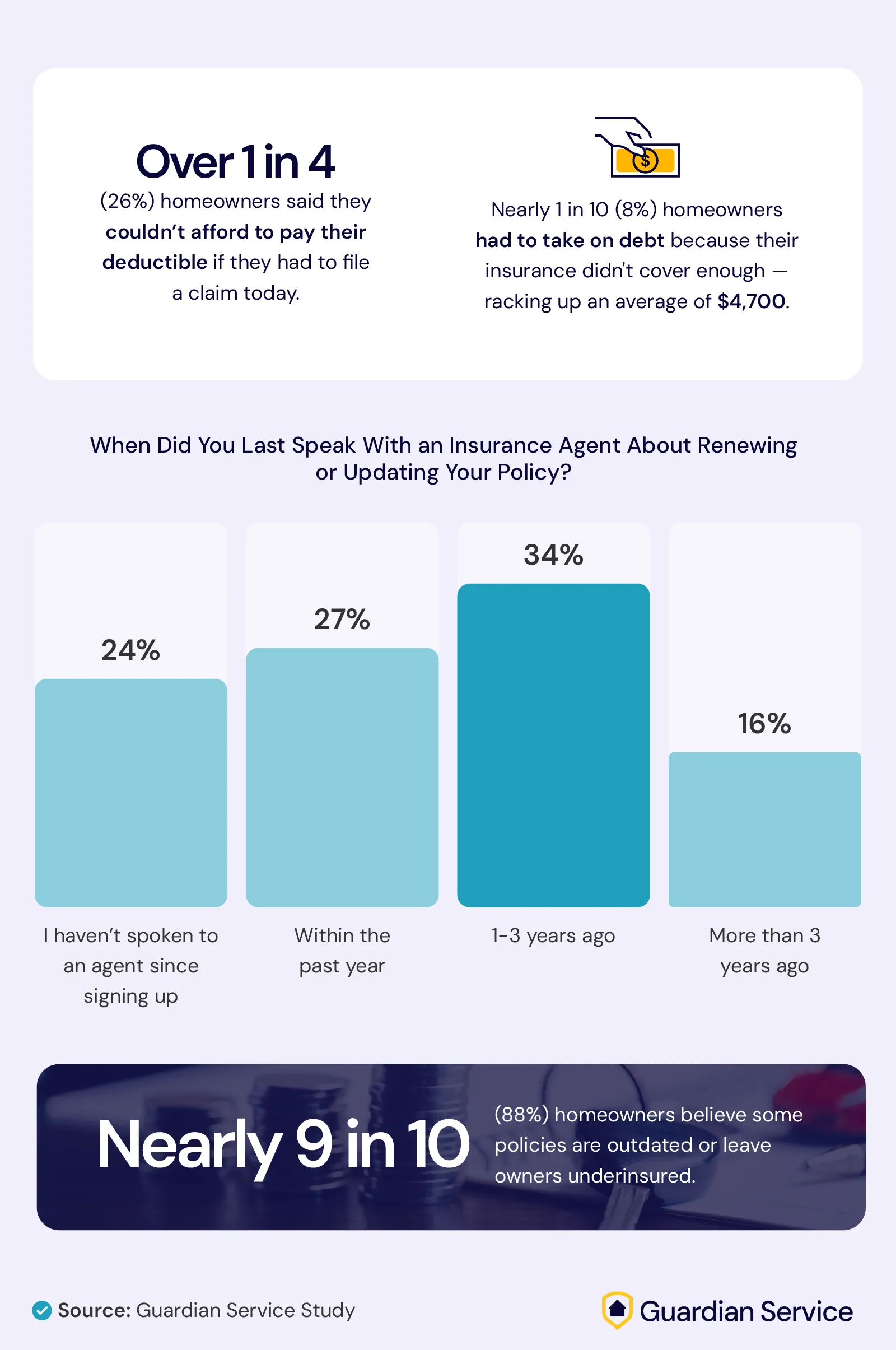

- Over 1 in 4 (26%) homeowners say they couldn’t afford to pay their deductible if they had to file a claim today.

- Nearly 1 in 10 (8%) homeowners have had to take on debt because their insurance didn’t cover enough, accruing an average of $4,700 in the process.

- Nearly 9 in 10 (88%) homeowners believe some policies are outdated or leave owners underinsured.

How Well Do Homeowners Understand Their Coverage?

When it comes to home insurance, confidence doesn’t always mean clarity. See how well homeowners understand their coverage, how much effort they put into researching policies, and where generational gaps begin to show.

Despite being the least confident in their understanding, Gen Z is actually the most optimistic about their coverage. Nearly 7 in 10 Gen Z homeowners (69%) believed their insurance would fully cover any major disaster, compared to just 47% of baby boomers, 51% of Gen X, and 50% of millennials.

Yet, when asked if they truly understand their policy, only 55% of Gen Z said yes, the lowest rate of any generation. Baby boomers were the most confident in their knowledge (73%), followed by Gen X (62%) and millennials (59%). Overall, 1 in 5 homeowners (20%) admitted they don’t fully understand their home insurance policy.

More than half of all homeowners (53%) haven’t read their full policy, leaving many at risk of unpleasant surprises when filing a claim. Gen Z and baby boomers were the most likely to have actually read their entire home insurance policy (53% and 55%, respectively). Millennials (46%) and Gen X (44%) were less likely to have taken that step, which could explain the gap between perceived and actual understanding.

Many homeowners also admitted to skipping their homework. While 42% said they researched and compared policies, the majority did not. About 29% chose a familiar provider without much research, 17% relied on a lender or agent’s recommendation, and 11% can’t even recall how they picked their policy.

When Disaster Strikes, Are Homeowners Financially Ready?

Insurance is meant to offer peace of mind, but that only works when coverage actually aligns with real-life costs and risks. We next look at how financially prepared homeowners feel, how often they review their policies, and what happens when coverage falls short.

Many homeowners may be one unexpected event away from financial strain. Over 1 in 4 (26%) said they couldn’t afford to pay their deductible if they had to file a claim today. Baby boomers led in financial readiness (86% could cover their deductible), compared to 79% of Gen X and just 68% of millennials and Gen Z.

Millennials were also the most likely to go into debt after finding out their policy didn’t cover enough, with 10% reporting they had to borrow money, followed by Gen Z (8%), baby boomers (6%), and Gen X (5%). On average, 8% of homeowners took on $4,700 in debt due to a lack of insurance coverage. The average debt racked up by generation was as follows:

- Baby boomers: $7,300

- Gen X: $5,500

- Millennials: $4,200

- Gen Z: $3,200

Despite these risks, many homeowners rarely revisit their coverage. About a quarter (24%) haven’t spoken to an insurance agent since signing their policy, and another 34% haven’t had a check-in for 1 to 3 years.

That lack of engagement may be contributing to costly surprises. More than 1 in 10 (11%) homeowners have experienced a denied claim or disappointing payout due to a coverage gap, and 18% aren’t even sure how their coverage stacks up against their home’s current value.

It’s no wonder that nearly 9 in 10 (88%) homeowners believe some policies are outdated or leave them underinsured. Regular check-ins and updated coverage reviews could make a meaningful difference in avoiding debt and disappointment down the line.

Gaps in Knowledge Could Lead to Gaps in Coverage

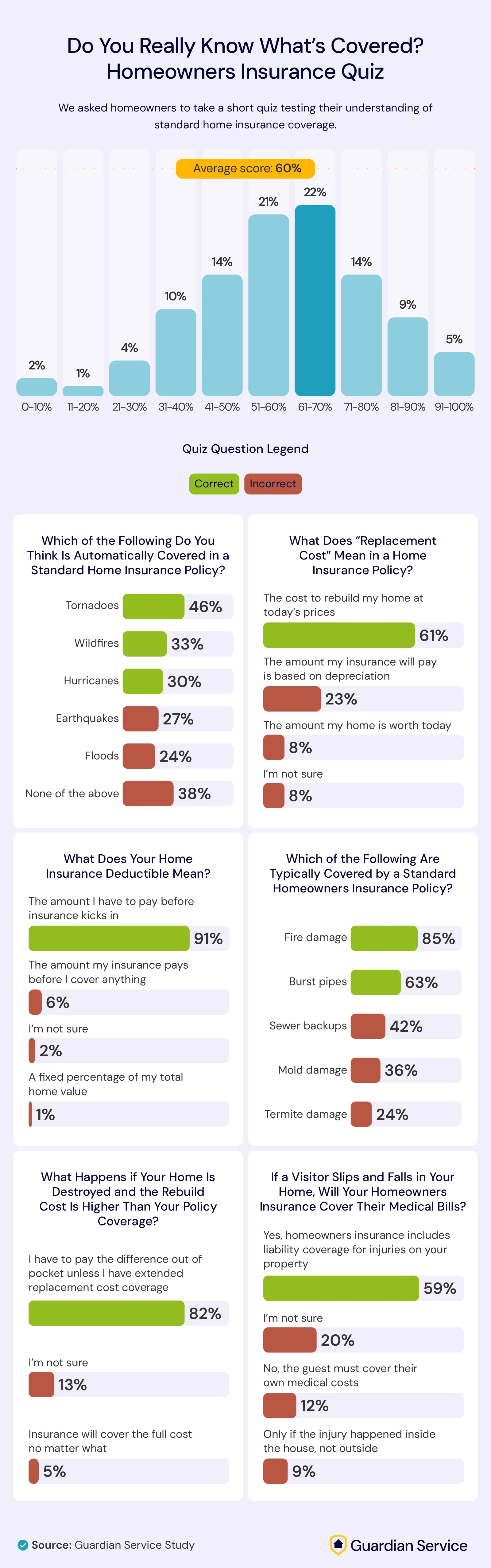

Even though many people feel confident about their insurance, some still struggle with the finer details of their policies. Homeowners took a quiz about basic insurance knowledge and shared how they learned about coverage and what they wished they had done differently.

The average score on our short home insurance quiz was just 60%. Baby boomers scored the highest at 64%, followed by Gen X and Gen Z (62% each) and millennials (60%). Some homeowners said they wished they’d asked more questions before signing their policy (30%), while others admitted they didn’t compare quotes (26%) or didn’t fully understand key terms (24%) before getting their policy.

When looking for home insurance information, 50% of homeowners relied on insurance agents or brokers. However, Gen Z charted its own course. Over 1 in 4 (26%) turned to YouTube for guidance, which was significantly higher than millennials (10%) and Gen X or boomers (8% or less). When asked how to avoid coverage surprises, homeowners pointed to a range of proactive strategies.

Reading the policy carefully (57%) and shopping around for quotes (52%) topped the list, followed by keeping a home inventory (48%), asking detailed questions (48%), and reviewing coverage annually (45%). Others recommended choosing a realistic deductible (44%), adding disaster-specific protection like flood, earthquake, or sewer backup coverage (41%), and increasing policy limits to reflect today’s rebuilding costs (39%).

Why Coverage Confidence Starts with Clarity

The results are clear: Too many homeowners are unsure about what their policies actually cover, and that confusion could cost them. From skipped research to misunderstood terms, the gaps in insurance knowledge are surprisingly common, even among those who feel confident in their coverage.

But there’s good news, too. A few smart habits can go a long way. Reading policies thoroughly, reviewing coverage regularly, asking detailed questions, and choosing a deductible that fits your budget are all proven steps homeowners can take to stay protected. Turning to credible sources for guidance could also make a big difference.

Ultimately, home insurance should offer peace of mind, not painful surprises. The better homeowners understand their coverage, the more empowered they’ll be when it matters most.

Methodology

We surveyed 1,006 American homeowners to explore how well homeowners understand their insurance coverage in 2025. The generational breakdown was Gen Z (8%), millennials (51%), Gen X (30%), and baby boomers (11%). Survey data was collected in March 2025.

About Guardian Service

Guardian Service makes shopping for home insurance easier, more affordable, and less stressful. We also offer utility line warranty plans to cover costly repairs that standard home insurance doesn’t. With a customer-first approach, we help homeowners protect what matters most while keeping the process simple and transparent.

Fair Use Statement

You’re welcome to use this data for noncommercial purposes, provided you include a link back to the original page.