North Carolina Homeowners Insurance Report (2025): Base Rate Hikes to Impact Homeowners Statewide

North Carolina Homeowners Insurance Report (2025): Base Rate Hikes to Impact Homeowners Statewide

Starting June 1, North Carolinians’ home insurance premiums are going to increase by an average 7.5%, translating to $243 more per year.On June 1st, North Carolinians’ home insurance premiums increased at a base rate of 7.5%.

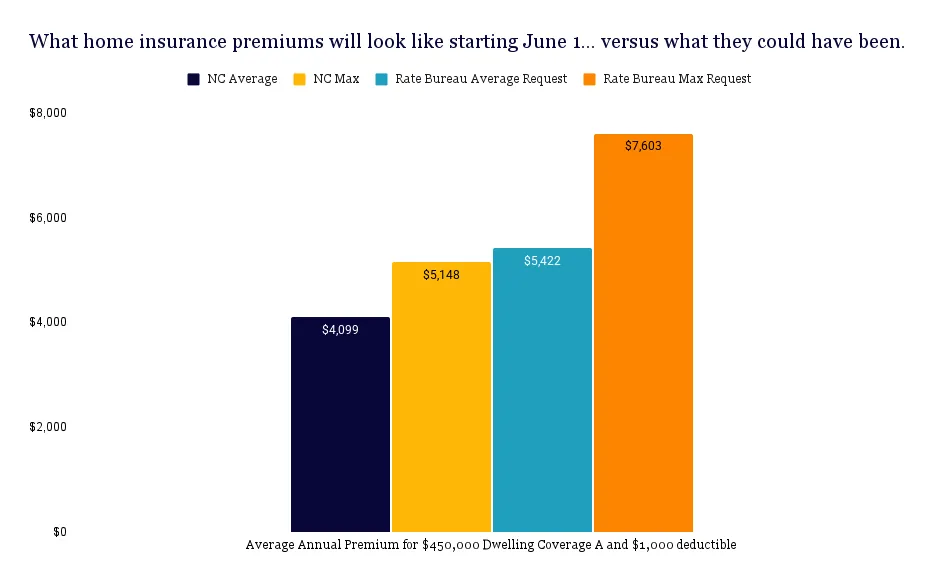

The average North Carolinian will pay $243 more per year, reflecting a 7.5% increase that went into effect June 1, 2025. The N.C. Rate Bureau originally came to Insurance Commissioner Mike Causey requesting an average 42.2% home insurance rate increase across North Carolina (what would have been an extra $1,609 per year for some homeowners). Causey negotiated limiting that increase to 7.5%.

Our latest comprehensive analysis provides detailed premium data to help North Carolina homeowners prepare for these changes.

The average statewide base rate increase agreed upon between Commissioner Causey and the N.C. Rate Bureau (7.5%) is many degrees lower than what the N.C. Rate Bureau originally requested (42.2%). The N.C. Rate Bureau originally requested increases of up to 99.4% in some NC regions. Along with the 7.5% average increase, Causey negotiated a statewide increase maximum of 35%.

“Homeowners across North Carolina – especially in growing metros like Raleigh – are feeling the impact of rising property insurance premiums,” explains Jon Ruggiero, licensed insurance agent and Vice President of Sales at Guardian Service. “With inflation, climate-related risks, and tightening underwriting guidelines all driving up costs, it’s more important than ever to take a proactive approach to your coverage.”

North Carolina homeowners should anticipate notable shifts in their insurance premiums based on their specific coverage selections and deductibles. For example, homes insured at $450,000 dwelling coverage A with a $1,000 deductible (annual premiums averaging $3,813) could increase approximately 7.5%, translating to an additional $286 annually. Those opting for higher deductibles like $2,500 or $5,000 may experience smaller increases or potentially lower overall premium adjustments.

Comparatively, premiums vary significantly among major providers. Homeowners insured with lower-cost carriers like State Farm, Farm Bureau, and Lititz Mutual typically pay an average $1,911 ($450,000 dwelling; $1,000 deductible) in annual premium. With an average 7.5% increase, these homeowners will pay $143 more per year. Homeowners insured with higher-cost carriers such as Erie and Farmers will pay an average $476 more per year.

“Rate adjustments can vary dramatically between carriers, depending on everything from local loss history to their appetite for specific property types or zip codes,” Ruggiero explains. “For North Carolina homeowners, that means there’s real value in shopping smart. The most competitive carrier for your home last year may not be the best fit this year. Pricing, underwriting guidelines, and available discounts can shift significantly year over year – especially in today’s dynamic market.”

Cost of North Carolina Home Insurance Premiums After 2025 Rate Hike

| City | **

Average Annual Premium with June 1 Increase** |

| --- | --- |

| Raleigh | $3,413 |

| Durham | $3,385 |

| Charlotte | $3,053 |

| Greensboro | $2,855 |

| Winston Salem | $2,830 |

North Carolina’s 7.5% statewide base-rate rise is only a starting point. Beach territories from Carteret to Brunswick will see 16% in 2025 and 15.9% in 2026, driven by repeated hurricane losses and soaring coastal re-insurance costs (NCDOI, AP). Mountain counties such as Buncombe and Yancey absorb just 4.4% and 4.5% thanks to lower catastrophe exposure. Raleigh-Durham matches the 7.5% average, while Charlotte climbs 9.3% then 9.2% because of higher rebuilding expenses. AP News attributes the hike to construction-inflation, stronger storms and rising re-insurance, evidence echoed by Commissioner Causey, who limited any territory to 35% increases. Household deductibles and claims will amplify or mute bills.

How North Carolina Homeowners Can Lower Their Homeowners Insurance Premium

While you may not be able to control industry-wide rate increases, there are several high-impact moves homeowners can make to help offset rising premiums and keep their insurance costs in check.

-

Take advantage of roof replacement discounts: One of the most significant credits available on a homeowner’s policy comes from having a new or recently replaced roof. Insurance carriers view newer roofs as less risky – which means lower premiums for you. Of course, replacing a roof is a major investment, but if it’s something you’ve been delaying, now may be the right time to move forward. Not only can it improve your property value and protect your home – it can also pay long-term dividends in premium savings.

-

Consider increasing your deductibles: Raising your deductible is another effective lever. While this does mean taking on more out-of-pocket cost in the event of a claim, it can offer immediate savings on your monthly or annual premium. If you’re comfortable managing that risk and have a strong claims history, this strategy can be a smart way to regain a sense of control over your insurance costs.

“The bottom line? Even in a hard market, policyholders still have options,” Ruggiero says. “Working with an independent advisor can help you evaluate the right trade-offs based on your property, budget, and long-term goals.”

How to Choose Home Insurance in North Carolina

Concerned about your homeowners policy and whether or not you're getting the best rate? North Carolina homeowners can speak directly with a local insurance expert at Guardian Service by calling (844) 910-4158 or visiting [guardianservice.com](http://guardianservice.comuardian Service is an independent insurance agency based in Raleigh, North Carolina, reimagining the insurance experience by simplifying the process and reshopping your insurance for you, to ensure you get the best coverage at the best price. Our zero-commission agents will work with you to understand your risk, scan the market, and find the best coverage at the best price with no analysis, complicated jargon, or hassle. Never shop for insurance again.

Media Contact:

Kara Credle

Communications Manager

Guardian Service

(844) 910-4158

[kara@guardianservice.com](mailto:kara@guardianservice.com

*The above NC premium data were sourced from Quadrant Information Services.